FintechZoom Netflix Stock

Gain a thorough understanding of Netflix stock through FintechZoom’s expert insights.

Explore its financial performance, industry standing, and growth potential with the latest trends and market evaluations.

This analysis provides an in-depth look at Netflix’s stock movement, key financial indicators, and the factors influencing its market position.

Understanding FintechZoom

FintechZoom is a trusted financial news platform that delivers real-time updates, market analysis, and expert reports for investors, traders, and financial enthusiasts.

It covers various aspects of the financial world, including stocks, cryptocurrencies, commodities, and personal finance.

The platform is widely known for its in-depth research and market insights, helping investors make informed decisions based on accurate and up-to-date data.

Netflix Stock: A Market Leader in Entertainment

Netflix Inc. (NFLX) is a dominant force in the streaming industry, offering an extensive content library of films, TV shows, and documentaries.

Since its public debut in 2002, Netflix has evolved from a DVD rental service into a global streaming giant, reshaping how audiences consume digital media.

Its ability to anticipate market trends and adapt to changing consumer preferences has played a significant role in its sustained growth and success.

From DVD Rentals to Streaming Giant

Netflix’s shift to streaming in 2007 marked a turning point in the entertainment industry.

By introducing its digital platform, the company transformed how people accessed and enjoyed media content.

The launch of original programming, beginning with House of Cards in 2013, further solidified Netflix’s competitive edge.

Today, the company invests billions in content production, leading to consistent subscriber growth and increased revenues.

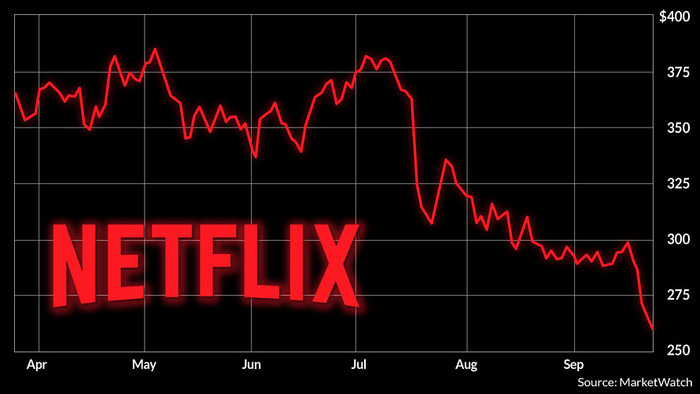

Stock Performance and Financial Strength

Netflix’s financial performance has been impressive, driven by a growing global subscriber base and strategic investments in content creation.

The company’s revenue has surged over the years, reflecting its ability to effectively monetize its vast user network.

Investors and analysts closely track Netflix’s financial health using key indicators, such as:

| Financial Metric | Significance |

| Subscriber Growth | Reflects demand and market reach |

| Average Revenue per User (ARPU) | Measures profitability per subscriber |

| Content Expenditure | Indicates investment in quality programming |

| Operating Margin | Measures profitability after operating costs |

| Free Cash Flow | Shows available cash after expenses |

Despite its strong performance, Netflix faces challenges such as rising content production costs, growing competition, and market saturation in certain regions.

The company must continuously innovate and expand its offerings to maintain its industry leadership.

Investor Sentiment and Market Perspectives

Investor confidence in Netflix remains high due to its strong market presence and innovative business model.

The company has consistently demonstrated its ability to adapt to consumer trends and technological advancements, contributing to its stock’s strong performance.

However, some analysts caution that Netflix’s valuation is steep, and the competitive streaming scene poses potential risks.

Key factors influencing investor sentiment include:

- Content Strategy – The quality and diversity of Netflix’s original programming.

- Subscriber Retention – The ability to maintain and expand its user base.

- Global Expansion – The effectiveness of its international market penetration.

- Profitability Metrics – Revenue growth, cost management, and operating margins.

Competitive Challenges in Streaming

Netflix operates in a highly competitive industry, with several major players vying for market dominance.

Competitors like Disney+, Amazon Prime Video, HBO Max, and Apple TV+ continue expanding their subscriber bases by offering exclusive content and competitive pricing models. Among these, Disney+ stands out for its rapid subscriber growth and strong brand portfolio, factors that have also influenced recent DIS stock trends in the market.

These platforms leverage their extensive resources and well-established brand presence to challenge Netflix’s market share.

The streaming wars have intensified in recent years, increasing the pressure on Netflix to differentiate itself. The key competitive challenges include:

- Content Costs – The rising expenses associated with producing high-quality shows and movies.

- Subscriber Churn – Retaining users in a market with increasing options.

- Regional Competition – Adapting content to different cultural preferences and regulatory environments.

- Technological Innovation – Enhancing streaming quality, AI-driven recommendations, and user engagement features.

Role of Fintech Platforms in Stock Analysis

Financial technology platforms such as FintechZoom are instrumental in helping investors track and analyze Netflix stock.

These platforms offer real-time updates, expert insights, and detailed reports that clearly show stock performance.

FintechZoom allows users to monitor stock trends, earnings reports, and market forecasts, making it easier to make well-informed investment decisions, whether for entertainment giants like Netflix or through detailed Amazon stock analysis.

FastBull: Another Valuable Financial Tool

Alongside FintechZoom, FastBull is another critical platform that provides market analysis and financial insights.

It specializes in trading signals, investment strategies, and educational content, making it an essential resource for novice and experienced traders.

FastBull also offers forex and binary options trading tools, enabling investors to diversify their portfolios efficiently.

The platform’s user-friendly interface and advanced analytics help investors easily handle the complexities of financial markets.

Final Thoughts

FintechZoom and FastBull are crucial in analyzing Netflix stock and the broader entertainment market.

Their real-time updates and expert insights allow investors to stay ahead of market trends and deal with financial uncertainties effectively.

As the streaming industry evolves, these platforms will remain valuable tools for those looking to make strategic investment decisions.

Netflix’s journey from a DVD rental service to a streaming powerhouse is a testament to its adaptability and vision.

However, as competition grows and market dynamics shift, the company must continue innovating to sustain its growth.

Investors should closely monitor Netflix’s financial performance, competitive strategies, and market trends to make informed decisions about its stock.

Risk Disclaimer:

Trading and investing come with inherent risks. The insights provided here are for informational purposes only.

Investors should conduct thorough research and assess their financial objectives before making investment decisions.